Big U-turn ahead! I started this blog in April 2008, actually it was probably a couple of months later and backdated the first few posts. I’d started working full-time online in the previous October. I didn’t have a clue. I was full-time because I didn’t have a job, not because I was making any money! I was going to be a success by Xmas. Maybe this Xmas?

At the time I called this blog “Passive Income” – because that’s what I wanted, and because I thought “passive income” would be a good term to rank for in the search rankings (it wasn’t – but I got to page 1 before a specific Google penalty knocked me off).

Niche Websites – Rise and Fall

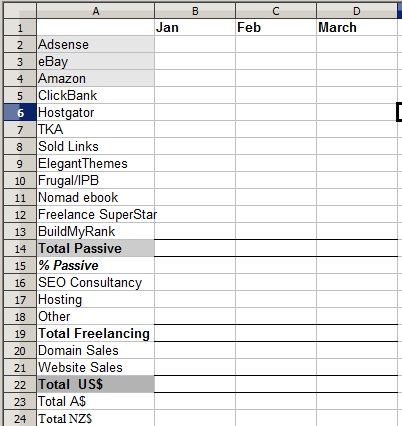

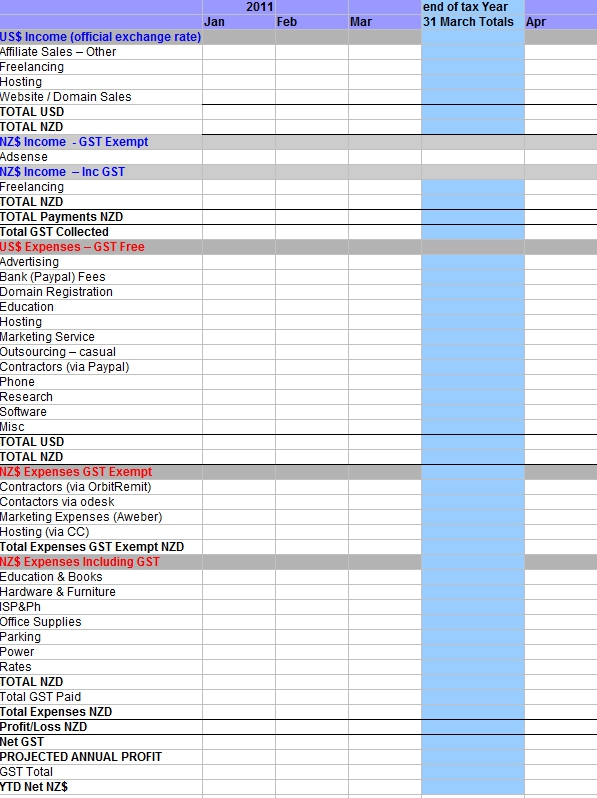

My best ever Adsense month was January 2011 – I made $1383 dollars. I made the same again in a range of affiliates which ranged from Amazon to The Keyword Academy. In April 2012 the Penguin update by Google which penalized sites which had built links with insufficiently varied anchor text. The next month my Adsense was down to $700.

In August 2013 I made about NZ$46 (say US$38) from Adsense. The penalised sites haven’t recovered, and I haven’t bothered building any others. I could, and contrary to what Google would have you believe, you can still get them to rank. But they are vulnerable. And I don’t like having my business being controlled by Google – they employ more PhD’s than me – they will win.

eBooks Rise and Rise

eBooks on the other hand are the same, but different. I repeated history and started with writing my passion – travel. I make a hundred or two from my books – but the market is small and the competition tough.

If Amazon changes their policies around indie authors, I’ll feel the pain. But not so much. You see the secret to eBooks – for me anyway – came with the success of my quick guide on how to format Kindle books. I wrote the book in frustration – not as a strategy.

On the back of it I launched BookFormatter.com. I started making regular money freelancing – my doing for people what I explained how to do in the book! Never, ever think that giving away technical “secrets” is a bad thing, many people, having acquired the knowledge will happily outsource to a person they trust to do a good job – you know like the author of the book!

I’ve been in this game – mostly full-time – since 2007. In that time everything has changed. Hubpages and been and gone, Niche websites have been and gone (for me). I’ve been a writer and a book formatter, A website designer and an email marketing consultant. When I started social media didn’t really matter. The controversies and flame wars happened on blogs not facebook! Search traffic were the committed buyers – now more and more people buy through social media recommendations.

Working for Passive Online Income

Until this year most of my effort has been basically on building passive income. Ultimately I’ve failed at that. Google changed the rules, my attempts at manipulating the search results failed, and I didn’t have the heart to re-build. I couldn’t see it working for a many more years anyways. Google is becoming less and less important to informing how people make buying decisions.

Working Online – How Did I Do It?

- I got paid on shared-revenue sites: Hubpages to BubbleWS

- you get paid for your skills by others needing your skills i.e. freelancing

- you get paid for recommending other people’s products (affiliate sales)

- you don’t control your income because you don’t control the terms of service of the sites that pay you

Advantages

- takes little skill to get started

- the rewards can be quick

- you can learn a lot and make a lot of connections

- it’s perfect if all you want to do is work online and not deal with hard-core “selling” (raises hand)

- when it works you really do make money in your sleep – I came back from a 2-month overseas trip with more money in my bank than when I left!

Disadvantages

- it’s not long-term recurring income regardless of what the third-party promises

- your income is controlled by terms of service you don’t control

- as an affiliate you ride the wave up and down of the service or company you’re promoting

- for mainstream products e.g. Amazon, eBay – affiliate marketing is basically dead because of the way Google now prefers it’s own brands in the search results

- unless you’re very, very clever you are building someone else’s brand and not yours

Examples

- writing for revenue share on sites like HubPages, Squidoo, BubbleWS etc

- publishing books on Amazon and other sites

- developing websites which are designed for ranking in Google and getting visitors from search traffic only

- making money from Adsense and affiliate sales from websites which rank in the search results

- freelancing via third-party sites such as odesk and eLance

Developing An Online Business

How Does It Work

- you offer something that people want, that you can deliver and that people will pay for

- you develop website, social media etc – with the purpose of getting people on an email list

- you may use third-party sites like Amazon to get your message/name/brand out there – but the ultimate purpose is to push people to sign-up for your email list

- you develop a website and an email list that you control. Traffic comes from a variety of sources which include social media and Google

Advantages

- control – you control your product and you have access to your customers, if Amazon suddenly decides to offer only a 40% royalty you can decide to move your customers elsewhere

- you can leverage customers and offer more expensive services and products to a smaller group – you can ultimately make more money with less effort, and it is sustainable

- developing an online, or mainly online business, costs very little money

Disadvantages

- it takes far more self-belief and confidence than just developing an online income

- it takes some more technical skills

- it takes more business skills

- you have to develop some basic ability to explain why your offering may be useful to someone (“marketing”)

Exciting Times

The last few months I’ve done a fair bit of freelancing – it pays the bills – but it’s also done something much more important than that – as a direct result

Freelancing made it obvious to me that there was a gap in the market, and realise that I could help fill that gap.

I’m currently buzzing with a new business venture a business partner and I will launch before the end of the year. We know there’s market demand. We believe we can fill the gap. We have the skills to make it happen and have identified a launch platform. Plus it will pretty much use all the skills I’ve learned in the last 6 years – plus a few new ones 🙂

You might want to sign up for the newsletter – in the box that will appear below in a second… There may be a special deal in the offing for subscribers… Can’t say much else – after all I’m trying to build excitement and buzz. Oh and we are still making it up!

I’ve gotta say – if I can find the skills to start a business – than anyone can! Seriously.

Happy Thanksgiving to the Americans – may your turkey and shopping go well. And the family thing if you approach it the traditional way!