There was a recent thread in the forum at TKA regarding managing your Internet Marketing income which I added my 2c to. I then got quite a number of PMs from people asking me follow up questions – given the thread wasn’t even mine – I guess my commonsense approach to record keeping and taxes are not so common. So here’s what I think is important – your mileage may vary.

My approach is quite simple – I’m not an accountant – though I did pass ACCY101 a million years ago. I have never found a “system” which manages multiple currencies the way I need to – so I developed my own. I use an OpenOffice spreadsheet – but any spreadsheet program which can sum figures and do the odd bit of multiplication will do just fine. The system has evolved over the years – but I’ve never had to start again. If I didn’t have some complex real estate investments I could do my own taxes off these figures – as it is I give them to my accountant.

Having a system to record your expenses and payments is what’s important – once you have that you can do your taxes – or give the figures to someone else to do. But either way you need to provide the basic figures.

Online Income and Record Keeping

Ignoring taxes to start off with – the first thing you need to have in place is a way to manage your online income. Long before I was making enough to worry about tax – I used to track my monthly income – it kept me sane and motivated. If you don’t know what you are earning how do you know how to improve it?

Tracking Income as You Earn it.

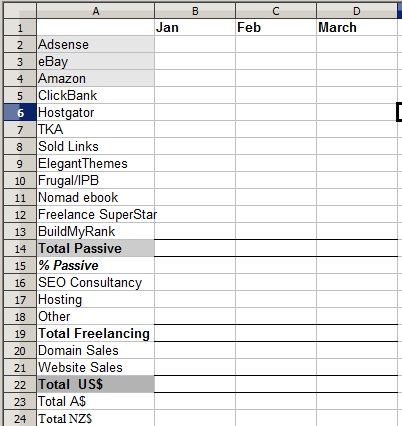

So my first spreadsheet was very simple: each column across the page is a month – and ever row was a source of income. As a I got more sources of income I simply added more rows in.

I split my income three ways:

- truly passive – ie advertising and affiliate sales

- not at all passive income – freelancing – one row per a client plus some more general one off stuff I do like hosting other people’s site and generic SEO consultancy.

- one-off income – from selling domains or websites – which tend to really be windfall income while the other two groups are more ongoing.

Initially I thought that my three biggest earners would be Adsense, Amazon and eBay and that’s why they are highlighted – its never really worked out that way – I generally suck at eBay and Amazon – but I keep the highlighting …I don’t really know why 🙂

This spreadsheet is dead easy to maintain – near the start of the month I login to all my major affiliates and check what I earned for the previous month – note I won’t have been paid yet by most of them – but I look at the earnings.

Managing Passive Income in a Foreign Currency

American readers can probably skip this section. I don’t live in the US but most of my income is made in US$. I decided early on to manage all my income for planning purposes in US$ – I have my goals in US$ I worry about whether my income is going up or down in US$. Now this is different to whether my income is going up or down in my local currency – but I can’t control the exchange rate so I don’t worry about it to much – I focus on the US dollars. Note my paypal account is in US$ – its my cheap foreign currency account really.

To come back to the currency that matters to me – ie the currencies I pay taxes in and spend money in – I have an conversion line to my local currencies. I use a conversion published by my local tax department to keep thing consistent

Tracking Income as You are Paid It

The above spreadsheet worked for several years. Yes I didn’t track expenses (they were too low to mention, as was my income) and yes I recorded income when I earned it not when I was paid it (again something I couldn’t control). But then I started earning more passive income – and I needed to add a second sheet to my spreadsheet – to record income as I was paid it (this is what the accountants call an cash basis). Certainly in Australia and New Zealand if you are a small business or individual you can chose to pay taxes only on what you have been paid – not what you have earned – that’s what I do.

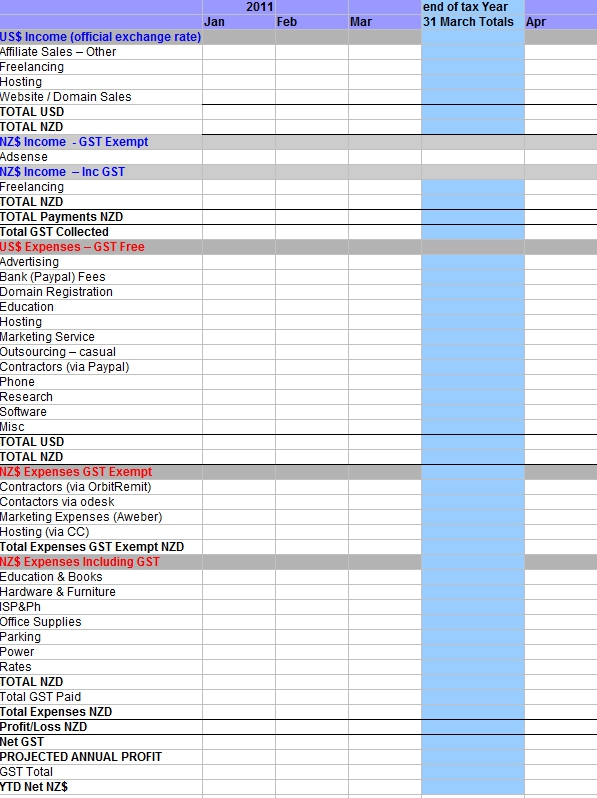

So I added a second sheet to my spreadsheet it looks like this:

Although most of my income is earned in US$, Adsense then pays me direct into my local bank account i.e. in NZ dollars – where I get a payment (or make a payment) in NZ$ I account for it as such. The US$ payments and expenses have to be converted to NZ$ for my tax records.

I also do work for local clients – who obviously pay me in NZ$. We have a local tax (GST, like VAT or other sales tax) which I need to apply for local clients but not for overseas income.

My local tax department allows you to chose my own conversion rate – so long as its believable and consistent – they also publish monthly figures for major currencies – I use their’s – fewer room for arguments. Whatever you do – be consistent – for your own sanity if nothing else.

Of course if you are earning enough to earn tax you really need to start tracking your expenses – after all why pay more tax than you have to?

All of my direct business expenses are paid via Paypal in US$ including domain registration, membership site subs, backlink services (Advertising), software etc etc.

However there is also the whole other bunch of expenses which are at “home”. These include both paying my contractors (when its from a local bank account), books I buy locally, electornics and furniture for my home office, a percentage of my ISP expenses, my house insurance, my Council rates, home maintenance, power, parking (for local clients) paper and printer supplies – it adds up – and it all comes off the profit BEFORE I pay tax.

I keep records – well I keep the receipts and throw them in an envelope a month – if I needed them I could prove these expenses. (I do expect to be audited one day by the tax department – my business is so “odd” in terms of amount of overseas income and low local expenses I am sure it will blow an automatic whistle at some point).

At the bottom of the page I do a couple of things – I project my annual profit – I take the last 4 months of my NZ$ profit/loss – divide it by 4 and multiple it by 12 – thus projecting an annnual income – its useful a) to shut up those who still think I just play online and b) it gives me an idea when I will have to start paying provisional tax.

The YTD NZ$ is just my total net profit for the tax year. Our tax year end is 31 March – so at the end of March I use the blue column to total all figures for the year and for the tax return.

Online Income and Tax Residency

Tax residency is not always the same as where you live. Often it is – but not always. For example if I – a New Zealand tax resident – decided to move to somewhere with very low taxes (e.g. most of the oil rich nations) – I may be resident in Saudi or Dubai – but I would still be a tax resident of New Zealand. That’s because New Zealand taxes me on my income – wherever in the world I might live. You can in fact be tax resident in two different countries at the same time – but that’s rare.

The above spreadsheet takes me about an hour a month to maitain. I download the figures from my affiliates, I download the month’s data from PayPal and allocate it to the various expenses/income categories that I use in the spreadsheets. I look up the figures on the household bills and use a separate sheet ot itemise them and work out the % that I am claiming.

15 replies on “Making Passive Income, Record Keeping and Online Income Taxes”

It was very insightful to see how a blogger maintains his accounts. Generally in this kind of a business it is easy to lose head with all the income streams coming in and especially being paid with foreign currencies and having to pay the tax in the local one!! but the way you explain it it seems simple and also the NZ tax system seems to keep it simple too. Thanks for this post

I know exactly what you mean about tax residence. I live in the Philippines but all my income is taxed by the US. It’s going to be one or the other regardless, but most of my income is from the US anyway, so why bother to use multiple currencies and crap like that?

Still, every year, I pull my hair out doing conversions from pesos to dollars and mainly because my son’s tuition and fees are paid with pesos and all my utility bills are in pesos.

@RT as a expat US citizen do you still have to pay taxes on US income – I thought you guys didn’t after you’d been away for a while?

My particular situation is complicated by the fact that my wife has been going back and forth. Once she’s in-country for good, it will be easy because I won’t owe anything.

Oh that makes sense!

Good, simple system here, Lis. And to be sure, you hit on a very important point. No matter who does your taxes, you have to keep records … folks who have never had to pay and then suddenly find themselves liable are really in a pickle. A good tax accountant can fix up all the official stuff, but s/he can’t really go back and recreate records you didn’t keep.

An interesting reason to keep good records also is, for US taxpayers overseas(and perhaps some other countries), it may be possible to exclude a lot of income as ‘foreign earned’, becuase you earned it while living outside the US. Don’t try this without a competent tax professional, but I know it works for some, and it’s a another good reason to live abroad in a low cost, happier country.

Even if I was in one of those awesome countries with no tax – I’d still keep most of these records – how can you run a busienss without the figures?

In Europe you are tax resident in whichever country you live in, so I’m a Spanish tax resident and don’t pay UK tax even tho I’m a pom. It can get into weird realms when you only spend a portion of the year in different countries, but that’s another story.

My spreadsheet is a little more complex than yours Lis, but it basically does the same thing with currency conversions etc.

Under Spanish tax laws, all worldwide earnings must be accounted for and Spanish income tax paid on them if you live and your work is done in Spain.

I could get around this and locate my business outside Spain (Gibraltar is favourite here) and pay Gibraltar corporate tax which is a flat 10% – a lot less than elsewhere in Europe. That means opening a Gib office/address and bank account to be legit, which the rebel in me has trouble with LOL! Gib is only an hour and a half drive from where I live, so its very tempting. Especially as my projected earnings online for this year will mean paying way too much tax for my liking. Nice situation to be in tho!

Congrats on paying too much tax Terry! That’s an interesting point – sounds like if I moved to Spain I’d end up being tax resident in both NZ and Spain – what a pain!

Lissie – Very useful spreadsheets. Is there an easy place to determine want types of income and expenses are GST exempt/free (assume it varies between countries a little?). And then from there and insights on how/whether you manage the GST aspect?

In NZ GST is payable on any good or service bought or sold within the country – except for rents and financial transactions – it makes it very,very easy. Your mileage will vary everywhere else though.

Wouldn’t be easier to use software like Quicken where you can track all your daily personal/business expenses and income and which you allow to set up accounts in different currencies?

Vi – I tried a product similar to Quicken – didn’t really give me what I wanted – which was a one page overview of my business

Hi Lis,

Firstly I must say thanks for inspiring me to carry out my plans for making extra money online. I have had this idea for a while now and I just didn’t know where to start. I just have a few questions and would be grateful if you can please help me out. I know that as a NZ Tax resident I am taxed on worldwide income earned, however how do I know what conversion rate to use?

IRD had end of month and rolling 12 month rate and I am not clear as to the difference between the two or if it would make an impact on my tax obligation. Thank you.

Jade

One is the rate at the end of the month, one is a rolling average – I just use the end of the month – because most of my money comes in at the end of the month its seems like it will the closest. I don’t think IRD cares, just be consistent, i’m pretty sure that what my accountant said