It’s exciting – Amazon sent you a ROYALTY CHECK it’s less exciting when you notice they’ve withheld 30% of the gross amount for taxes 🙂 The money is not gone forever though – as a non-US resident author the process of getting your money back is not difficult. It involves some phone calls and a some paper work – that’s it. The process has simplified in the last year or so – so if you’ve found a guide which starts talking about needing to get an “apostilled” coy of your passport – that’s all nonsense now. Here’s how it works 2013.

The overall process is:

- get an US tax number called an EIN (NOT an ITIN – that way is the way of apostilled copies, Form W-7 and other nonsense). Even if you are a sole-trader, as I am, you can get an Employer Identification Number – it’s perfectly legit as a non-resident alien (as Americans so charmingly call foreigners) and MUCH easier than getting an ITIN

- tell Amazon and Smashwords of your new EIN – using a W-8BEN form this will stop them withholding 30% (the actual amount they will continue withhold depends on your country of tax residents: for New Zealanders it’s 5% for Australians 0%)

if you have had any royalties withheld already – you will need to claim them back from the IRS (US tax department) using a 1040NR form.UPDATE: You won’t get your previous over-paid tax back unless you go through the trauma of getting an ITIN

Getting an EIN (Employer Indentification Number)

Before you call you will need:

- a way to call the US cheap: I use Skype my call was about an hour and cost about 10c – most of the time was on hold – so I wouldn’t use Telecom for this!

- plan the time of day/week the IRS office is open 7am-10pm Mon-Fri – but general advice appears that they are busiest in the mornings and less busy in the evenings. You are calling Pennsylvania – so that is approximately NZDT: middnight – 3pm Tues-Sat (timeandate.com for timezone conversions)

- a print out or on-screen copy of Form SS-4 – it’s the form they are going to fill in on your behalf, so they ask if you have a copy. YOU don’t actually need a copy -just have it on a screen near you to follow along.

The details are:

- Call 001-267-941-1099 extension #3. You are calling for an Employer Identification Number (EIN) NOT an Individual Identification Number (ITIN).

- After a wait of between 5 and 60 minutes you’ll be answered. You aren’t allowed to be on speaker phone, so do this with a headset is my recommendation (means you can do some work while you are on hold).

- They will ask you if you are applying for an EIN for a foreign entity – the answer is YES

- Ensure that you give them a legal name that matches your legal name with Amazon and other places you sell your book and your records with IRD in New Zealand. The spelling is critical – they will go over it a few times.

- You don’t need a trading name.

- If your postal address is different from your residential one then again you will need to clearly spell it out. This is a unit used to dealing with foreigners and they seem un-perturbed over my lack of a “state” or “province”.

- You are a “sole proprietor”

- They will ask you if this is for compliance with withholding – the answer is YES

- They will ask you if this is for e-books – the answer is YES. Or they may ask you what business you are in: “PUBLISHING” appears to cover it.

- They will give your EIN over the phone – write it down – and double-check the number.

- Eventually the paper copy will turn up, mine went via the UK for some reason! That paper is VERY important, original document, not the cheap computer-generated print-out it looks like. KEEP IT SAFE you can’t get a copy – apparently.

Telling Distributors about your EIN

You need to send a physical paper copy of a W8-BEN form to the places that have or will withhold taxes on your behalf. For most of us this is:

- Amazon.com

- Smashwords.com

Completing a W-8BEN

Go and get a copy of the form from the US IRS site here -. Print it out nice and legibly on white paper with black ink. Find a pen – file it in so your name and address and your EIN the details should match those you just gave the IRS. Do not abbreviate. You don’t live in NZ – you live in New Zealand. Do not photocopy the completed form – do an original for each distributor you are sending it to.

Question 9

cross a) and enter New Zealand

cross b) leave the rest blank

Question 10

For New Zealanders the answers are:

article 12

rate 5%

type of income: royalty

Sign and date the form and send it to:

Amazon: address for W8-BEN Amazon will send you an email in a few weeks to acknowledge receipt and in your next cheque you’ll notice the different rate of withholding applied.

Smashwords: address for W8-BEN – update the EIN on your account page, and send to the address provided. Once received the hold for payments will be automatically removed and the withholding rate changed to 5%

You apparently have to re-do this print out and mail nonsense every three years.

I Want My Money Back!

If you did all the above before you sold any books then you can stop now. However, for the rest of us who have procrastinated about getting our tax affairs in order, and will now have to one more fun step to get your cash back!

Smashwords defaults to holding your royalties until you have filed a tax number with them, as they only pay four times a year, it’s worth timing getting your EIN to fit with their payout dates. Amazon however may well have withheld more tax than is necessary. Amazon can’t give it back to you – only the IRS can do that.

The US tax year ends on the 31 December – and some time afterwards Amazon will send you a 1042-S – I received mine in March – so the timing is not bad for the NZ tax year date of 31 March.

The 1042-S states how much Federal Tax has been withheld and your gross income.

For New Zealanders you can get most of that back. The last 5% you claim against your New Zealand tax. No you can’t just claim it all against your NZ tax – only that 5% which is legitimate under the relevant tax treaty.

Filling in a 1040NR Getting Your US Tax Back

Okay the form you can find here: The instructions all 19 pages – here.

You will also need your 1042-S from Amazon (and any other US distributors) which say how much tax has been withheld.

I’m making some assumptions here: you aren’t an expatriate American, you don’t run a business in the US or have employees there. On page 4 of the instructions you should qualify for the “simplified procedure for claiming certain refunds” . (Yes after this you will never hate the IRD again!).

Basically if you are/have :

non-resident aliendon’t have a business in the USno income connected with a US businessyou don’t owe the US any taxyou are using the form ONLY to claim a refund of tax withheld at source

You can now fill the form as follows:

Page 1: make sure you name, addresses and EIN are as previously given to the IRS. Leave the rest of the page blank.

Page 3: leave blank

Page 4: Royalties are item #5 enter the amount of Gross Income from the 1042-S (box 2) that Amazon sent you. Enter under column (d)(Other Specify) 5% .

Follow the simple arithmetic as indicated in lines 13, 14, 15 . This figure is what you owe the US IRS (which you can claim back via your New Zealand tax). Copy this figure to page 2 line 53

Page 5: answer all question. Most are straightforward and relate to your citizenship, residency and trips to the US.

For item L leave blank

Now back to page 2

You already have the estimated tax to pay on your royalties @ 5% on line 53

Line 60 – is probably the same as line 53

Line 61(D) is the amount Federal tax withheld from box #7 on your 1042-S form(s) (total if you have more than one). Enter this

Line69,70 – simple maths.

Line 71A – you want the amount REFUNDED to you – they will send a US$ check to your postal address on page 1.

Sign and date form.

You’ll need to attach part of the 1042-S send to you from Amazon (Copy C – attach to any Federal Tax Return). Attach form to the left margin of page 1.

Mail to

Department of the Treasury

Internal Revenue Service

Austin, TX 73301-0215

USA

The return is due before the 15 April, though as they owe you money I don’t think they will care if you are late!

Update: Unfortunately all I got back was a letter telling me EIN did not match an SSN or ITIN. I called and after talking to several people at IRS I discovered that I couldn’t get my overpaid tax back with and EIN. Most annoying!

Standard Disclaimer: I am not a tax accountant, but I have done taxes in a few countries – and I have great deal of sympathy for my American friends who have to deal with level of literal paper work.

Your mileage may vary – if in doubt – check with a tax professional.

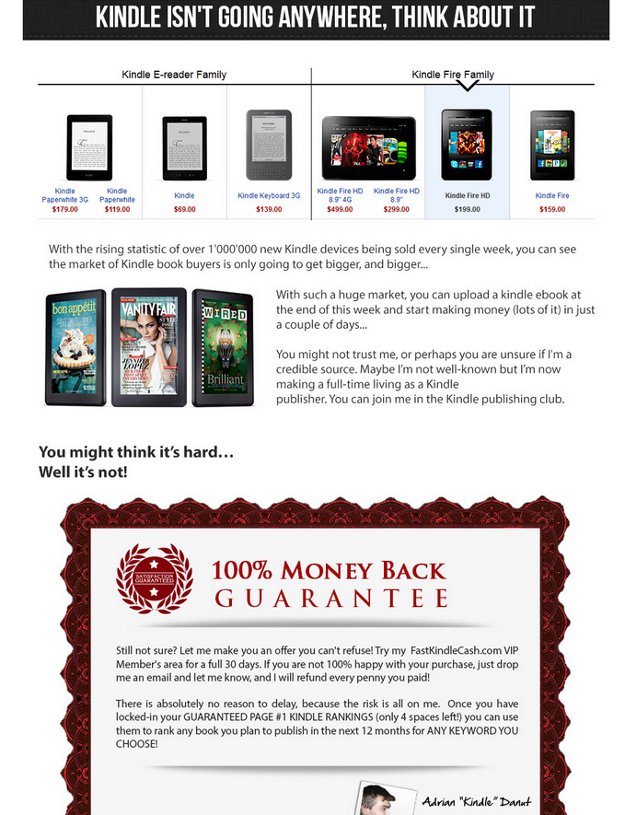

Notice the juxtaposition of Kindle/Amazon known trusted brands and Adrian who? But he’s giving you a guarantee that’s worth something isn’t it? Yeah right. Under this name there is no such author on Amazon – funny that.

Notice the juxtaposition of Kindle/Amazon known trusted brands and Adrian who? But he’s giving you a guarantee that’s worth something isn’t it? Yeah right. Under this name there is no such author on Amazon – funny that.