There was a recent thread in the forum at TKA regarding managing your Internet Marketing income which I added my 2c to. I then got quite a number of PMs from people asking me follow up questions – given the thread wasn’t even mine – I guess my commonsense approach to record keeping and taxes are not so common. So here’s what I think is important – your mileage may vary.

My approach is quite simple – I’m not an accountant – though I did pass ACCY101 a million years ago. I have never found a “system” which manages multiple currencies the way I need to – so I developed my own. I use an OpenOffice spreadsheet – but any spreadsheet program which can sum figures and do the odd bit of multiplication will do just fine. The system has evolved over the years – but I’ve never had to start again. If I didn’t have some complex real estate investments I could do my own taxes off these figures – as it is I give them to my accountant.

Having a system to record your expenses and payments is what’s important – once you have that you can do your taxes – or give the figures to someone else to do. But either way you need to provide the basic figures.

Online Income and Record Keeping

Ignoring taxes to start off with – the first thing you need to have in place is a way to manage your online income. Long before I was making enough to worry about tax – I used to track my monthly income – it kept me sane and motivated. If you don’t know what you are earning how do you know how to improve it?

Tracking Income as You Earn it.

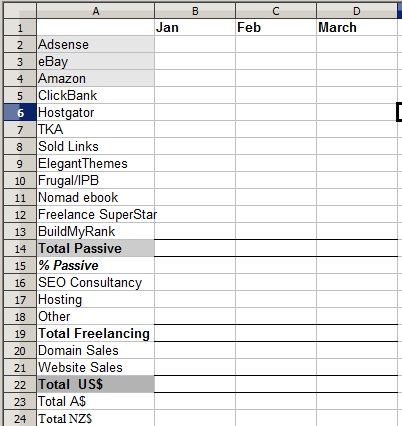

So my first spreadsheet was very simple: each column across the page is a month – and ever row was a source of income. As a I got more sources of income I simply added more rows in.

I split my income three ways:

- truly passive – ie advertising and affiliate sales

- not at all passive income – freelancing – one row per a client plus some more general one off stuff I do like hosting other people’s site and generic SEO consultancy.

- one-off income – from selling domains or websites – which tend to really be windfall income while the other two groups are more ongoing.

Initially I thought that my three biggest earners would be Adsense, Amazon and eBay and that’s why they are highlighted – its never really worked out that way – I generally suck at eBay and Amazon – but I keep the highlighting …I don’t really know why 🙂

This spreadsheet is dead easy to maintain – near the start of the month I login to all my major affiliates and check what I earned for the previous month – note I won’t have been paid yet by most of them – but I look at the earnings.

Managing Passive Income in a Foreign Currency

American readers can probably skip this section. I don’t live in the US but most of my income is made in US$. I decided early on to manage all my income for planning purposes in US$ – I have my goals in US$ I worry about whether my income is going up or down in US$. Now this is different to whether my income is going up or down in my local currency – but I can’t control the exchange rate so I don’t worry about it to much – I focus on the US dollars. Note my paypal account is in US$ – its my cheap foreign currency account really.

To come back to the currency that matters to me – ie the currencies I pay taxes in and spend money in – I have an conversion line to my local currencies. I use a conversion published by my local tax department to keep thing consistent

Tracking Income as You are Paid It

The above spreadsheet worked for several years. Yes I didn’t track expenses (they were too low to mention, as was my income) and yes I recorded income when I earned it not when I was paid it (again something I couldn’t control). But then I started earning more passive income – and I needed to add a second sheet to my spreadsheet – to record income as I was paid it (this is what the accountants call an cash basis). Certainly in Australia and New Zealand if you are a small business or individual you can chose to pay taxes only on what you have been paid – not what you have earned – that’s what I do.

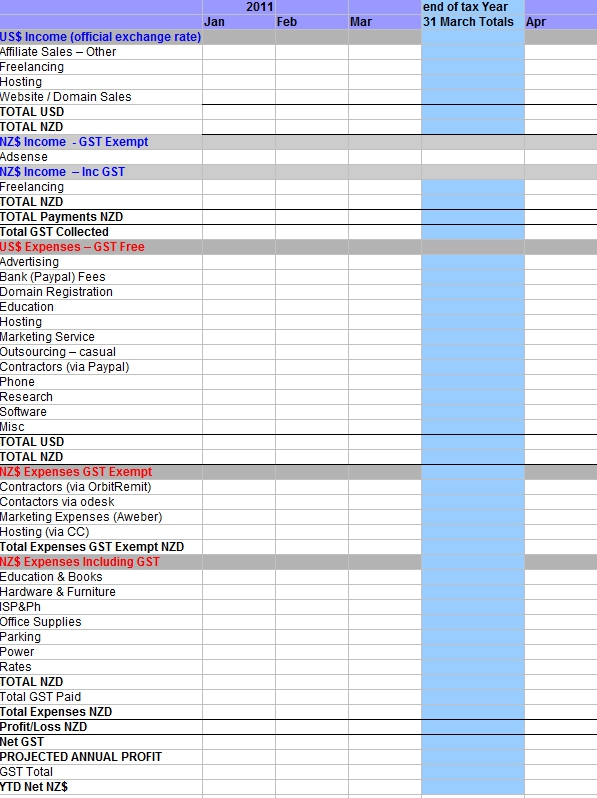

So I added a second sheet to my spreadsheet it looks like this:

Although most of my income is earned in US$, Adsense then pays me direct into my local bank account i.e. in NZ dollars – where I get a payment (or make a payment) in NZ$ I account for it as such. The US$ payments and expenses have to be converted to NZ$ for my tax records.

I also do work for local clients – who obviously pay me in NZ$. We have a local tax (GST, like VAT or other sales tax) which I need to apply for local clients but not for overseas income.

My local tax department allows you to chose my own conversion rate – so long as its believable and consistent – they also publish monthly figures for major currencies – I use their’s – fewer room for arguments. Whatever you do – be consistent – for your own sanity if nothing else.

Of course if you are earning enough to earn tax you really need to start tracking your expenses – after all why pay more tax than you have to?

All of my direct business expenses are paid via Paypal in US$ including domain registration, membership site subs, backlink services (Advertising), software etc etc.

However there is also the whole other bunch of expenses which are at “home”. These include both paying my contractors (when its from a local bank account), books I buy locally, electornics and furniture for my home office, a percentage of my ISP expenses, my house insurance, my Council rates, home maintenance, power, parking (for local clients) paper and printer supplies – it adds up – and it all comes off the profit BEFORE I pay tax.

I keep records – well I keep the receipts and throw them in an envelope a month – if I needed them I could prove these expenses. (I do expect to be audited one day by the tax department – my business is so “odd” in terms of amount of overseas income and low local expenses I am sure it will blow an automatic whistle at some point).

At the bottom of the page I do a couple of things – I project my annual profit – I take the last 4 months of my NZ$ profit/loss – divide it by 4 and multiple it by 12 – thus projecting an annnual income – its useful a) to shut up those who still think I just play online and b) it gives me an idea when I will have to start paying provisional tax.

The YTD NZ$ is just my total net profit for the tax year. Our tax year end is 31 March – so at the end of March I use the blue column to total all figures for the year and for the tax return.

Online Income and Tax Residency

Tax residency is not always the same as where you live. Often it is – but not always. For example if I – a New Zealand tax resident – decided to move to somewhere with very low taxes (e.g. most of the oil rich nations) – I may be resident in Saudi or Dubai – but I would still be a tax resident of New Zealand. That’s because New Zealand taxes me on my income – wherever in the world I might live. You can in fact be tax resident in two different countries at the same time – but that’s rare.

The above spreadsheet takes me about an hour a month to maitain. I download the figures from my affiliates, I download the month’s data from PayPal and allocate it to the various expenses/income categories that I use in the spreadsheets. I look up the figures on the household bills and use a separate sheet ot itemise them and work out the % that I am claiming.